By S. S. Mundra, Former Deputy Governor, Reserve Bank of India

Customers who are financially literate would demand information and thereby play an important role in ensuring transparency among the financial institutions. The transparency in the market encourages institutions to compete on the basis of better products and services and at lower cost. That is what the informed customers bring into the market and ultimately it is beneficial because it expands the market and brings more and more new customers.

Demand side barriers

What are these demand side barriers? The first demand side barrier is more on personal level. A large number of people who have come into the financial system now have low or uncertain incomes. For them, any high fee or a stipulation like maintaining a minimum balance in the account it can become a barrier. This is what I call a personal barrier.

The second is, of course, the low level of financial literacy. If they don?t have that level of literacy, then they would not know about the availability, neither can they judge the products? suitability nor can they compare various products. When that does not happen for the new entrants to the financial system, it creates a trust deficiency. It does not break that hesitation to use the banking services. That is the second barrier.

The third barrier is low social and technological inclusion. What is social inclusion? The migratory population coming into the towns or cities find themselves displaced from their roots. They don?t have their ecosystem in place, whereby something like obtaining an address proof or a simple introduction becomes a challenge. So, these are the social inclusion challenges.

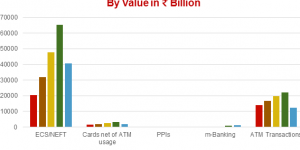

Similarly on technological side, the hesitation to use ATMs, mobile banking, net banking etc. These are the kind of things which act as a technological barrier.

And finally the fourth barrier – the linguistic barrier. India is a diverse country. There are so many dialects, so many languages and until and unless players deal with the consumers in respective area in the local language; unless the literature, the material is made available in the local language, the efforts towards connecting these consumers would never succeed.

Effectively, we have so much of supply side infrastructure available and at the same time we do have these demand side barriers. So the challenge before us is how to break the barriers on the demand side and make effective utilization of infrastructure which is created. The problem universally is that there is no dearth of policy. We have the best literature available which tell you what to do. You have consultants available who would also tell you what to do; you will also derive many conclusions from the conference and maybe list out dozens of what to do. The challenge is how to do it. So along with each what to do, if we can also outline how to do it, then only the purpose of such conferences would be served.

This becomes important win-win for both – for the consumer as well as the providers. If the consumers get service suitably, they develop the confidence and subsequently the requirement and the demand for this kind of product enhances. Consumers prosper and if they prosper they provide more business to the providers- it becomes a virtuous cycle. And then the industry and the service providers can reasonably expect to enhance their profitability and earnings by fair and transparent measures, rather than chasing profitability through all kinds of dubious means. Globally we have seen imprudent institutions getting into the mess and then requiring government bail outs. The regulators are forced to work hard to clear the left debris, when these unscrupulous players exit the scene.

I would like to mention that just the other day I came across a paper titled ?National Strategy for Financial Literacy-Count me in, Canada.? I found it to be quite a focused paper. The paper sets out goals and priorities to help Canadians better manage their finances and make appropriate decisions as their needs and circumstances change. It also calls on organizations to join efforts to help Canadians take action and make financial literacy a life-long journey. The strategy has clearly articulated three goals for the citizens:

manage money and debt wisely

plan and save for the future

prevent and protect against fraud and financial abuse

Courtesy: RBI