By Dr Viral V Acharya, Deputy Governor, RBI

To build credit models for individuals and small credits, the financier and its modelers are ideally required to know not just outstanding credit for the micro borrowers, but possibly also their entire repayment history and their cash flow fluctuations, so as to tailor the terms of credit suitably. In the absence of such information, many borrowers may simply get rationed out of the market due to severe information asymmetry faced by financiers.

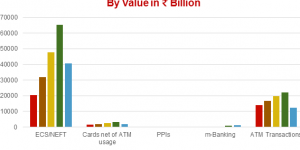

With a PCR tracking every credit transaction from its origination to closure (initial terms, repayment, default, restructuring, etc.), and being linked to various digital systems in place (as shown in the chart above), it would be possible to identify and get to know well businesses, even micro enterprises and micro entrepreneurs. In other words, the PCR could supply the missing link, which is the complete 360-degree view- information of the borrower or prospective borrower. This will allow lenders to assess the borrower’s credit risk keeping in view the viability of cash flows, ask the relevant questions (e.g., are there other underlying issues that are affecting ability to pay the loan in spite of healthy cash flows from the micro enterprise), and price the loan terms without compromising on due diligence.

Based on these, nearly-automated loan sanction and disbursement mechanisms can be devised, as are also being attempted by fin-tech companies.

In fact, credit products could get transformed with the possibility of sanctioning small ticket loans with short maturity and zero or low collateral requirement. Borrowers and entrepreneurs can build their reputation and credit quality by repaying well such initial information-building loans. Gradually, they can borrow more and at longer maturities, potentially making capital investments to enhance productivity. Once their size increases and they register with the GSTN, tax invoices can act as the cash-flow verification with PCR. Robust credit history built over a period can work as sturdy collateral, building the trust of the lenders. Such sachetisation of credit can rapidly expand access to credit for those micro and small enterprises, hitherto not included in the formal credit market.

As I stressed while describing the ability to pay and willingness to pay of micro entrepreneurs, it would remain important not to undermine their inherently strong credit culture by making it easier for borrowers not to repay. That would compromise the essence of how micro entrepreneurs build a reputable credit history to differentiate from others and over time grow in size and economic value creation.

Ultimately, while central banks are not always visible to the common person, their policies have the potential to touch her in a meaningful way. As its etymology suggests, this is what economics must help achieve in the end better management of the household. It is perhaps too ambitious a vision of our future to believe that a fundamental change in the financial data infrastructure such as a Public Credit Registry can help improve access to micro credit as well as improve schooling and skilling outcomes for our children and youth, but so be it. My son’s poster at his school last year introduced me to a gem from Michaelangelo, which underscores why we must keep painting such a vision and persist with efforts to convert it into reality. It says,

The greatest danger for most of us lies not in setting our aim too high and falling short; but in setting our aim too low, and achieving our mark. (Courtesy: rbi.org.in)